The current limitations in electricity storage transform the electricity supply process into a product of complex balance and coordination, beyond just energy generation. Achieving the delicate equilibrium where every kilowatt-hour produced matches what is consumed is one of the biggest challenges for the electricity market. Within these constantly shifting dynamics, a system that instantaneously matches supply and demand is essential. This article focuses on this critical operation of the energy market, particularly the Intra-Day Market and the risks posed to hydroelectric power plants (HPPs).

1. Introduction: From Day-Ahead to Intraday – Dynamic Market Realities

Electricity markets, by their dynamic nature, are constantly changing. The delicate balance between energy production and consumption presents both opportunities and risks for market participants. This dynamism makes planning processes more complex, especially for weather-sensitive generation facilities like hydroelectric power plants (HPPs).

“I planned, but the rain stopped” scenario

As a run-of-river HPP operator (one without a dam), your production planning for the day-ahead market (DAM) relies heavily on the expected rainfall for the following day. However, forecasts can change, and the anticipated rain might not materialize. In such a scenario, you face the prospect of generating less energy than planned. Conversely, you might receive significantly more rainfall than expected, causing water levels to rise rapidly, leading to the potential or necessity to produce above your planned output. These types of scenarios result in deviations between your scheduled production in the DAM and your actual generation.Changes in demand throughout the day: how flexible can energy supply be?

Electricity demand fluctuates continuously throughout the day; it rises in the morning, reaches peaks in the afternoon and evening, and declines at night. These fluctuations require supply to adapt to demand with similar flexibility. However, not every generation facility can offer the same degree of flexibility. While HPPs can offer a certain flexibility depending on hydrological conditions, it can be difficult for them to adapt quickly to sudden and large-scale changes. Maintaining the supply-demand balance in the system necessitates the instantaneous management of flexible generation capacities.

Why is DAM alone not enough for HPPs?

The Day-Ahead Market (DAM) is the fundamental planning platform of the electricity market, aiming to balance the production and consumption plans of market participants one day in advance (EPDK). However, for power plants reliant on natural resources like hydroelectric power plants (HPPs), sudden changes in hydrological conditions (e.g., rainfall amounts, water levels) can render the forecasts made in the DAM obsolete within the same day. This creates imbalances between planned and actual production, and relying solely on the DAM can lead to both operational inefficiencies and financial costs. Academic studies show that this imbalance and forecast deviation can be 30% or more on average. Therefore, additional market mechanisms are needed to manage the uncertainties that arise during the day and to provide flexibility.

2. What is the Intraday Market (IDM)?

The Intraday Market (IDM) is a market platform where electricity energy trading takes place after the closing of the DAM and before real-time balancing. It offers market participants the opportunity to adjust their positions determined in the DAM according to changes that occur during the day (EPİAŞ).

2.1. Differences Between IDM and DAM

The IDM, as its name suggests, is a market where electricity energy buying and selling transactions are carried out within the day (EPİAŞ). The DAM, on the other hand, is an organized wholesale electricity market where transactions are made for electricity energy to be delivered one day later (EPDK). The main difference is that the IDM is a platform for closer-to-real-time adjustments, allowing market participants to minimize deviations between their commitments made in the DAM and the actual situation.

Participants: producers, suppliers, YEK-certified plants

All licensed legal entities can participate in the Intraday Market (EPDK). This includes holders of generation licenses, supply licenses, and plants within the scope of the Renewable Energy Resources Support Mechanism (YEKDEM). This wide range of participants increases the market’s depth and liquidity.

2.2. IDM Operational Process

The IDM operates as an open market model with a continuous bid/ask system. This means that participants can continuously submit bids and make purchases for specific time periods (EPİAŞ).

Bidding – Matching – Evaluation Steps

The bidding process in the IDM begins with the submission of buy or sell offers for a specific day and time period to the market (EPİAŞ). The system evaluates these offers according to matching rules. Matched offers create a certain electricity supply or demand obligation for the relevant market participant (EPDK). This process is conducted via the market management system (MMS) (EPDK).

Hourly or block offer types

In the IDM, market participants can submit both hourly and block offers (EPİAŞ). Hourly offers include prices and quantities determined separately for each hour of a day, while block offers are submitted with a single price and changeable quantity information for a specific time interval (EPİAŞ). For example, if an HPP anticipates having excess water during a specific afternoon time slot, it can submit a block sell offer for these hours. (AI)

2.3. IDM Role for HPPs

DAM forecast doesn’t hold up → intraday positioning

For HPPs, the IDM plays a critical role when production forecasts made in the DAM do not match actual conditions. For example, an HPP commits to 20 MWh of production in the DAM but becomes capable of producing 25 MWh due to an unexpected increase in rainfall. In this case, the HPP can sell the extra 5 MWh through the IDM, avoiding a positive imbalance. Similarly, in case of a drop in water levels, it can purchase the missing production from the IDM, preventing a negative imbalance. (AI)

Opportunity to flex production plan in IDM

The IDM offers HPP operators the opportunity to flex and optimize their production plans according to instantaneous situations. This flexibility provides a proactive management possibility against unexpected hydrological changes and offers the potential to both minimize possible penalties and gain additional income.

Rapid change → need for the right tools + automation

The dynamic nature of the IDM requires quick decision-making and implementation capabilities. This increases the need for software solutions that provide accurate information flow and can perform automated transactions. Manual operations may be insufficient to keep up with rapidly changing market conditions and can lead to missed opportunities for timely transactions.

3. What is the Balancing Mechanism?

In the electricity market, instantaneously balancing supply and demand is of great importance. The balancing mechanism encompasses the activities designed to perform this critical task (EPDK).

3.1. TEİAŞ and System Operator Role

Turkish Electricity Transmission Co. Inc. (TEİAŞ) is the System Operator responsible for operating the Turkish electricity transmission system and for maintaining the real-time balance of electricity energy supply and demand (EPDK). TEİAŞ instantly controls frequency and voltage to ensure system reliability, and when necessary, issues instructions to generation facilities to increase or decrease load. These instructions are typically given within the scope of ancillary services such as reactive power and frequency control (EPDK).

3.2. Balancing Power Market (BPM) Operation

The Balancing Power Market (BPM) is part of real-time balancing and serves the purpose of maintaining the supply-demand balance in the system (EPDK). This market comes into play to address imbalances that may arise after IDM transactions.

Only selected plants: Can HPPs be “reserve service providers”?

In the BPM, balancing units that can change their output power within typically 15 minutes, meaning they have reserve capacity, are included (EPDK). These balancing units respond to the System Operator’s instructions to increase load (increase production/decrease consumption) or decrease load (decrease production/increase consumption) (EPDK). Hydropower plants, if they meet certain conditions (e.g., ability to quickly start up and adjust power output), can play an important role as reserve service providers in this market. In case of an energy deficit in the system, low-priced load-increasing offers are preferred, while in case of an energy surplus, high-priced load-decreasing offers are preferred (EPİAŞ).

4. What is Imbalance and Why is it a Serious Cost?

In electricity markets, imbalance is the difference between planned and actual production and consumption quantities. These differences can lead to significant financial consequences for market participants.

4.1. Imbalance Definition

Imbalance is the deviation between the Final Day-Ahead Production/Consumption Program (FDPCP) and actual production or consumption (EPDK).

- Positive (overproduction) imbalance: This occurs when a market participant produces more energy than committed in the DAM. For example, a plant that planned to produce 100 MWh in the DAM actually produces 110 MWh.

- Negative (underproduction) imbalance: This occurs when a market participant produces less energy than committed in the DAM. For example, a plant that planned to produce 100 MWh in the DAM actually produces 90 MWh.

4.2. Penalty and Impact Mechanism

How is the imbalance price determined? (SMF + deviation rate)

The imbalance price is determined on a settlement period basis, taking into account the System Marginal Price (SMP) and specified deviation rates (EPDK). The SMP is the offer price corresponding to the net instruction volume, determined by starting from the lowest load-increasing offer prices if the system has an energy deficit, and from the highest load-decreasing offer prices if the system has an energy surplus (EPDK, EPİAŞ).

For example, if there is an energy deficit in the system in the relevant settlement period, the SMP is determined starting from the lowest Load Increase Offer (LIO) prices. If there is an energy surplus in the system, the SMP is calculated starting from the highest Load Decrease Offer (LDO) prices. If the system is in balance, the SMP is equated to the market clearing price for the relevant settlement period (EPİAŞ). This mechanism reflects the cost of instructions given to keep the system balanced. The imbalance penalty is calculated by multiplying the market participant’s imbalance quantity by this price and applying the specified deviation rates.

Penalty calculation logic: example tables

Imbalance penalties vary depending on the market participant’s position and the market’s situation.

- Positive Imbalance (Overproduction): If an HPP overproduced and there is a system-wide energy surplus, the HPP may be forced to sell this excess production at a low price or even pay a penalty. For example, when there is an energy surplus in the system, if the Market Clearing Price (MCP) is 2500 TL/MWh, the SMP might be determined as 2200 TL/MWh. In this case, an HPP with a positive imbalance could be subject to a penalty of (2500 TL – 2200 TL) = 300 TL/MWh for each MWh it overproduced. (AI)

- Negative Imbalance (Underproduction): If an HPP underproduced and there is a system-wide energy deficit, the HPP is forced to purchase the missing energy at a high price. For example, when there is an energy deficit in the system, if the MCP is 2500 TL/MWh, the SMP might be determined as 2800 TL/MWh. In this case, an HPP with a negative imbalance could incur a cost of (2800 TL – 2500 TL) = 300 TL/MWh for each MWh it underproduced. (AI)

This calculation logic encourages market participants to adhere to their production and consumption plans as much as possible.

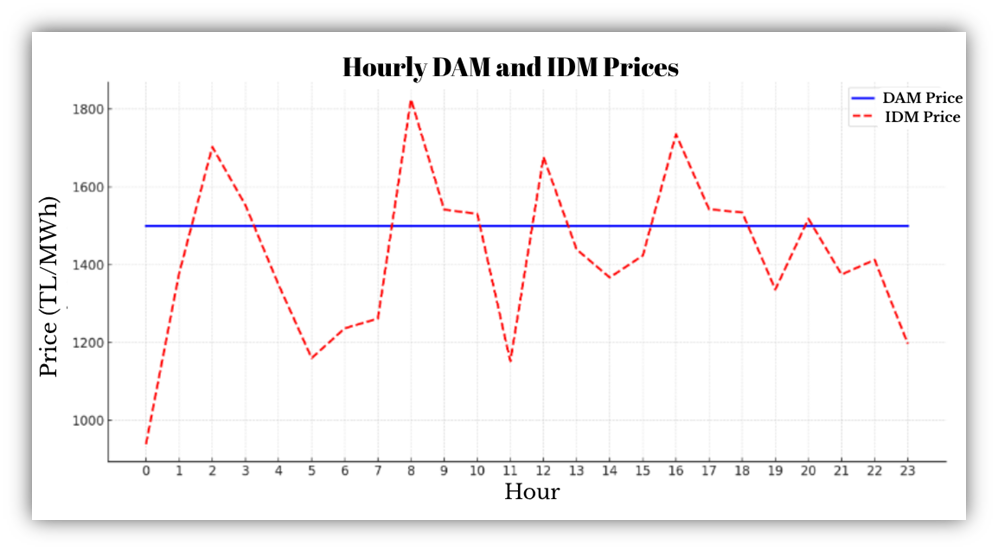

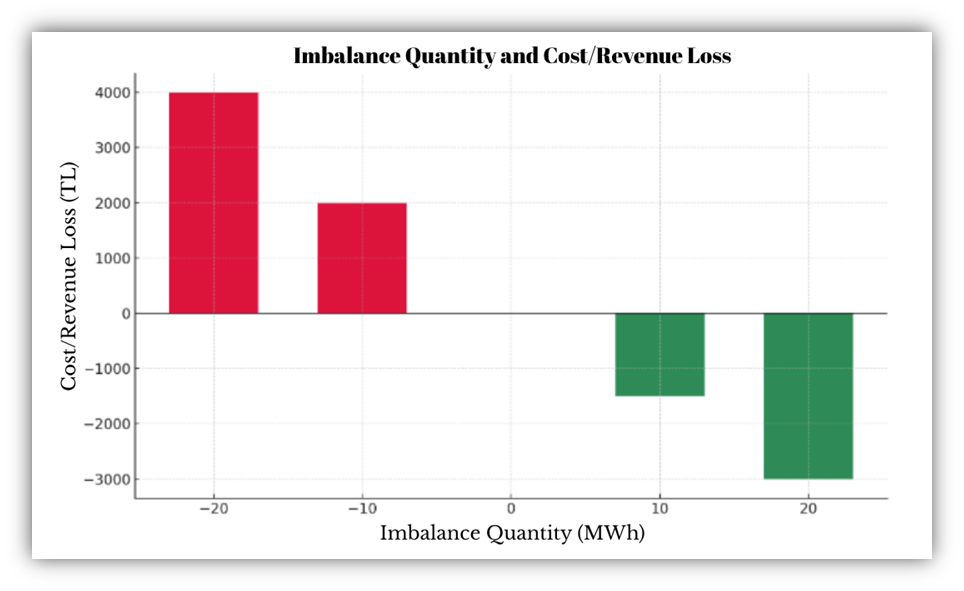

Financial impacts: DAM price 1400 TL, actual imbalance +/- 20%

Let’s assume the DAM price is 1400 TL/MWh.

- In a situation where an HPP planned 100 MWh and produced 120 MWh (20 percent over), if the overproduction imbalance price is 1200 TL/MWh, it might experience a revenue loss of (1400 – 1200) * 20 = 4000 TL for the extra 20 MWh it produced. (YZ)

- Similarly, if it planned 100 MWh and produced 80 MWh (20 percent under), if the underproduction imbalance price is 1600 TL/MWh, it might face an additional cost of (1600 – 1400) * 20 = 4000 TL for the 20 MWh it underproduced. (AI)

These examples demonstrate how imbalances directly affect the financial performance of businesses.

4.3. Impact of Imbalance on BGE Performance

Costs and penalties arising from imbalance are invoiced to the Balancing Group Entity (BGE) within the scope of the Balancing Power Market (EPDK). Each market participant assumes balancing responsibility either on its own behalf or by joining a BGE (EPDK).

Imbalance penalty invoiced to BGE

If an HPP is part of a BGE, the imbalance penalties caused by the HPP are directly reflected in this BGE. This situation can also mean costs for other participants within the BGE and negatively affect the group’s overall performance.

Constantly deviating HPP → risk of exclusion from BGE

An HPP that consistently causes large imbalances and thereby imposes costs on the BGE weakens the group’s overall balancing performance. This situation can lead to the risk of the HPP being excluded from the BGE. Exclusion from the BGE means that the HPP must assume balancing responsibility on its own, which entails additional management burden and financial risks. Therefore, minimizing imbalances is vital for HPPs to maintain their position in the market.

5. IDM and Balancing Strategies: Examples Specific to HPPs

Actively utilizing the Intraday Market (IDM) and Balancing Mechanism for hydroelectric power plants (HPPs) is key to increasing operational efficiency while reducing imbalance costs. Here are some scenarios specific to HPPs:

5.1. Scenario 1 – Drought: Forecast Low, Actual Production High

An HPP operator submitted a production offer of 10 MWh for the DAM. However, instead of the expected drought, sudden rainfall occurred, and the plant reached a production capacity of 14 MWh. If this 4 MWh of excess production is not evaluated in the IDM, the HPP falls into a positive imbalance and is potentially settled at a lower price than the SMP, leading to revenue loss.

Situation Corrected with IDM: The plant instantly offers the excess 4 MWh to the market, tracking the high prices in the IDM. Thus, it both avoids falling into imbalance and gains unexpected revenue. For example, if the current price in the IDM is higher than the DAM, the HPP can sell this surplus more profitably and generate additional income instead of paying a “penalty.” (AI)

5.2. Scenario 2 – Sudden Rainfall: Water Increased, Opportunity Missed

An HPP operator realized they received sudden rainfall after the DAM offer and could produce extra. However, they did not submit any offers to the IDM. At 3:00 PM, they saw that the instant price in the IDM was 2500 TL/MWh. If they had entered an offer in time, they could have made a significant profit by selling at this high price. Since no entry was made into the IDM, this production opportunity is missed, and potential revenue is also not gained. This situation is an example of an HPP’s flexible production capacity not being leveraged at the right time in the market. (AI)

5.3. Scenario 3 – System Reserve Call

TEİAŞ requested an HPP to produce additional electricity urgently to maintain the instantaneous frequency balance in the system. This instruction is given within the scope of ancillary services and ensures that the HPP receives a payment for the additional balancing service it provides to the system (EPDK). Thanks to its flexible production capability, the HPP responds quickly to this call, contributing to system reliability and creating an additional revenue stream. This scenario demonstrates that HPPs can play a critical role not only as basic production units but also for the stability of the system. (AI)

6. Renewasoft’s Solution: Your Real-Time Balancing Assistant

Renewasoft offers a comprehensive solution that enables HPP businesses to play a proactive role in the Intraday Market and Balancing Mechanism. This solution simplifies complex market dynamics and helps businesses optimize their financial performance.

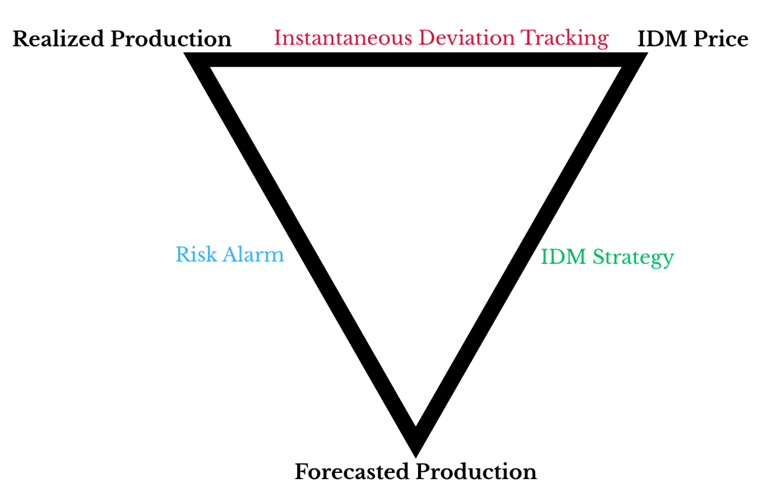

6.1. Forecast – Actual – IDM Triangle

Renewasoft visually matches and presents the production forecast determined in the DAM for each hour, the actual production, and the IDM prices for that hour. This allows HPP operators to easily track instantaneous deviations in their production. For example, the system automatically generates warnings such as “%15 negative deviation → risk alarm,” enabling intervention before an imbalance risk occurs.

6.2. IDM Monitoring and Automated Alerts

The platform continuously monitors IDM prices on an hourly basis. Through modules like “If MCP < IDM, intraday bid proposal,” it automatically suggests intraday bidding when the market clearing price is lower than the IDM price. Additionally, it informs HPPs of instant opportunities with automated notifications such as “2:00 PM IDM price 2800 TL – Production can be increased,” helping them earn additional income by increasing their production.

6.3. Imbalance Score and BGE Report

Renewasoft offers a special imbalance score tracking system for each user. This score indicates the HPP’s imbalance risk based on its past performance. It also helps the HPP take proactive measures by providing “risk entry” alarms through BGE internal contribution assessment, specifying the HPP’s position within the BGE and its potential risks.

6.4. KPI and Reporting Features

Renewasoft’s reporting features enable HPP businesses to analyze their financial performance in depth. By estimating monthly imbalance costs, they can foresee potential future financial burdens. Furthermore, the “profit saved through IDM usage” analysis clearly demonstrates the additional income gained and costs prevented through active participation in the IDM. These reports enable more informed business decisions.

7. Conclusion: Participate in the Market Proactively, Not Reactively

The volatile nature of today’s electricity markets requires a dynamic and proactive approach for generation units like hydroelectric power plants, going beyond mere planning. The Intraday Market (IDM) and Balancing Mechanism form the foundation of this proactive management.

The IDM is no longer just a platform used to correct errors in the DAM; it is also an important opportunity market for HPPs. The ability to provide flexibility against sudden changes in hydrological conditions, capitalize on excess production, or cover production deficits creates significant potential for increased revenue for HPPs through the IDM.

Coping with imbalance is a critical competency for modern HPP operations. Accurate forecasting algorithms, robust software support providing real-time monitoring, and automation systems with automated decision-making capabilities provide HPPs with a significant advantage in this process. Solutions like Renewasoft offer this integrated approach, supporting HPP businesses to remain competitive in the market and increase their profitability. Moving from being reactive to being a proactive market player is key to the future success of HPPs.

REFERENCES:

- EPDK: Energy Market Regulatory Authority, https://www.epdk.gov.tr

- EPİAŞ: Energy Markets Operating Company Inc., https://www.epias.com.tr