Electricity, while an indispensable energy source for modern civilization, is also the key to a market with complex economic and operational dynamics. The Turkish electricity market fully reflects this intricate structure, offering constantly shifting balances and opportunities. Understanding the intricacies of this market is critically important, especially for Hydroelectric Power Plant (HPP) operators and managers, energy trading managers, engineers and technical experts, energy market specialists and academics, and energy system and economics students (EPDK). In this comprehensive blog post, we will meticulously examine the fundamental pillars of the Turkish electricity market: the Market Clearing Price (MCP) and balancing mechanisms (EPİAŞ, EPDK).

1. Introduction: Why Is the Electricity Market So Complex?

The inherent complexity of the electricity market stems primarily from the imperative that electricity must be generated and consumed simultaneously (TEİAŞ). As electricity cannot be stored on a large scale, it necessitates a real-time, dynamic balance where supply and demand must match within milliseconds. The market mechanisms designed to achieve this delicate equilibrium result in a multifaceted structure, interwoven with numerous generation and consumption actors, transmission network constraints, and external factors (EPDK).

- EPİAŞ’s Market Making and Regulatory Role: Energy Markets Operations Joint Stock Company (EPİAŞ) is a central and regulatory arm of the Turkish electricity market. Beyond merely operating as a market operator, EPİAŞ is responsible for managing critical markets such as the Day-Ahead Market (DAM), Intra-Day Market (IDM), and Balancing Power Market (BPM). Its role extends to ensuring the transparency, reliability, and fair competitive conditions of these markets. EPİAŞ operates within the regulatory framework established by the Energy Market Regulatory Authority (EPDK), providing a level playing field for market participants and aiming to optimize the total cost of the system by ensuring the most efficient meeting of supply and demand (EPİAŞ).

- Unpredictability of Prices and Its Impact on HPPs: Electricity prices constantly fluctuate under the influence of countless factors such as meteorological conditions, global fuel prices, unforeseen plant outages, transmission constraints, and even geopolitical developments. This unpredictability creates strategic challenges, particularly for hydroelectric power plants (HPPs) (HESİAD). Unlike other power plants, HPPs have the ability to store their primary fuel, water. However, this advantage comes with the necessity of converting water into energy at the right time and at the right price. Hydrological conditions, such as drought periods or excessive rainfall, directly affect HPPs’ generation potential, while market price uncertainties turn production planning and, consequently, revenue forecasting into a complex chess game (DSİ).

- “Maximize Income, Not Production” Approach: In the traditional understanding of energy generation, the focus has often been on producing maximum electricity by utilizing the full technical capacity. However, in a competitive market environment, this approach doesn’t always yield the most profitable outcomes. Especially for resources with storage capabilities like HPPs, there has been a strategic shift: “Maximize income, not production.” This approach means using water as a resource when market prices are expected to be at their highest. For instance, instead of generating electricity late at night or during low demand periods, reserving water resources for times when high MCP values are expected during the day or week can significantly increase the revenue generated per unit of water. A deep understanding of MCP and balancing mechanisms is a crucial tool for HPP operators to implement this strategic vision. This ensures that power plants are not only technically efficient but also perform at the highest financial level (EPİAŞ).

2. Day-Ahead Market (DAM): What Is It?

The Day-Ahead Market (DAM) is one of the fundamental pillars of the Turkish electricity market. As the name suggests, it is an organized market where electricity is bought and sold on an hourly basis for the delivery day ahead (EPİAŞ). The DAM allows market participants (generators, consumers, and supply companies) to submit their production and consumption plans in advance for the following day and to engage in energy trading accordingly. This process provides the system operator (TEİAŞ) with a preliminary projection of the next day’s supply-demand balance, enabling the necessary adjustments for secure and stable system operation (TEİAŞ).

2.1. Definition of DAM and EPİAŞ’s Role

The DAM offers a transparent, competitive, and reliable platform for electricity trading.

- Free Market Logic and Price Discovery: The DAM is fundamentally a platform where supply and demand freely interact. Electricity generators submit sell bids considering their production costs, marginal costs, and expected fuel prices. Electricity consumers or retail companies enter their buy bids into the system based on their consumption expectations. This mutual interaction enables price discovery in the market. In other words, market participants directly contribute to the price-setting process based on their own forecasts (EPİAŞ, EPDK).

- 1-Day-Ahead Planning and Risk Management: One of the most important functions of the DAM is to allow market participants to lock in their electricity generation and consumption for the next day. This enables both generators to plan their fuel supply and operations and consumers to forecast their costs and budgets. It serves as a proactive risk management tool, especially against sudden market fluctuations (EPİAŞ).

- TEİAŞ’s Need to Maintain System Balance: Turkish Electricity Transmission Corporation (TEİAŞ) is the national transmission system operator responsible for the safe, stable, and uninterrupted operation of Turkey’s electricity transmission system. DAM results provide TEİAŞ with vital information about the expected supply-demand balance for the next day. With this data, TEİAŞ manages transmission constraints, determines necessary reserve capacities, and prepares for potential system imbalances. The DAM is an important leading indicator in TEİAŞ’s mission to ensure grid security (TEİAŞ).

2.2. Market Calendar and Timeline

Operations in the DAM occur within a strict calendar and timeline. This ensures equal conditions and market transparency for all participants (EPİAŞ).

- Hourly Bidding Times: Market participants submit their buy or sell bids for each hour of the next day (total 24 hours) to the EPİAŞ electronic platform until 11:30 AM daily (may vary for public holidays and weekends). A separate price and quantity bid can be submitted for each hour (EPİAŞ).

- Bid Revision Period and Closing: Participants can modify their bids as many times as they wish during the bidding period, based on their strategies or updated data. However, after the specified closing time of 11:30 AM, no further bid revisions are possible. This strict closing time is part of ensuring fairness and integrity in the market (EPİAŞ).

- Publication of Results and Acceptance Processes: After the bid closing, EPİAŞ’s advanced algorithm comes into play. Generally, around 12:30 PM, the DAM results, namely the hourly Market Clearing Prices (MCPs) and matched quantities, are published through EPİAŞ’s transparent platforms. Participants can view how their bids were matched through these results and complete their acceptance processes to finalize their operational plans for the next day (EPİAŞ).

2.3. Bid Types

The DAM offers various bid types suitable for different operational constraints and commercial strategies of market participants (EPİAŞ).

- Demand and Generation Bids: There are fundamentally two main bid types:

- Generation Bids (Sell): Indicate how much electricity generation plants commit to sell at a certain price (EPİAŞ).

- Demand Bids (Buy): Indicate how much electricity consuming entities or retail companies commit to buy at a certain price. Each bid includes a price and a quantity (in MWh) to be bought/sold at that price (EPİAŞ).

- Minimum – Maximum Production Limits: Production facilities (thermal power plants, HPPs, etc.) are technically constrained to operate within a certain minimum (technical minimum generation) and maximum (installed capacity or instantaneous capacity) production range. These limits are specified in the bids and considered by the matching algorithm (TEİAŞ).

- Flexibility: What is a Block Bid? Block bids are offers valid for a specific period consisting of consecutive hours (e.g., a 4-hour block). These bids operate on an “all or nothing” principle; meaning, either the entire bid is accepted, or it is entirely rejected (EPİAŞ). Block bids are strategically important, especially for HPPs with flexible generation capabilities or certain industrial facilities requiring continuous production. For instance, an HPP might submit a 4-hour block bid at a high price for the 12:00-16:00 period to capitalize on high price potential during midday. This is also a crucial strategy for pumped-hydro storage plants; block bids can be used to pump water during low-price hours and generate electricity during high-price hours (HESİAD).

2.4. Supply-Demand Balance and Price Matching

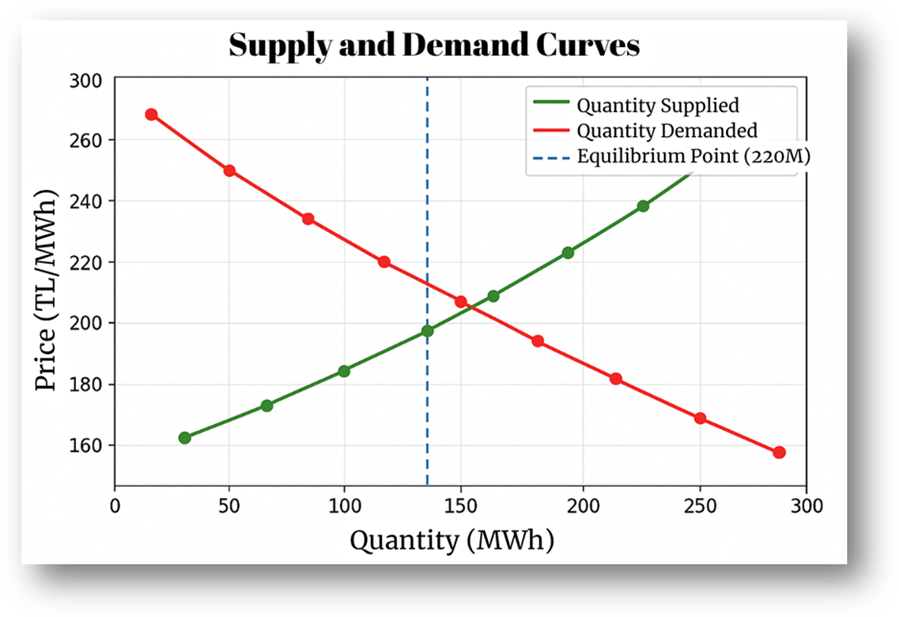

In the DAM, price formation occurs at the point where all bids are matched—that is, where supply meets demand. This process is typically guided by the “merit-order” system (EPİAŞ).

• Merit-Order (Supply-Demand Ranking):

EPİAŞ’s matching algorithm ranks all sell offers from the lowest to highest price, forming a supply curve. Similarly, buy offers are ranked from highest to lowest price to create a demand curve. This ordering is designed to ensure that the system operates at the lowest possible cost (EPİAŞ).

• How Is the System Marginal Price (SMP) Determined?

The SMP is the price formed at the intersection point of the supply and demand curves. This point reflects the cost of the last (most expensive) power plant needed to meet the total demand in the system. In other words, it represents the cost of supplying one additional unit of electricity for that hour. The SMP reflects the marginal equilibrium in the market (EPİAŞ).

• Determining the Clearing Offer:

During the matching process, all sell offers equal to or below the SMP and all buy offers equal to or above the SMP are accepted. This ensures that all market participants transact at the same price—the Market Clearing Price (MCP) (EPİAŞ, EPDK).

2.5. EPİAŞ Day-Ahead Market (DAM) Price Calculation Algorithm

EPİAŞ utilizes advanced software to manage the bid matching and market clearing price (MCP) determination process in the Turkish day-ahead electricity market. This system meticulously analyzes bids submitted by market participants to determine the MCP for each hour, as well as the matched quantity and price for each bid (EPİAŞ).

1. Bid Database and Structures: EPİAŞ collects all bids from market participants into a detailed database. There are three primary types of bids in the Turkish day-ahead electricity market: hourly, block, and flexible bids. Each bid includes at least one price-quantity pair and can be for buying or selling. If the quantity is negative, it indicates a sell; if positive, it indicates a buy. Quantities are expressed in lots, with one lot equivalent to 0.1 MWh.

- Hourly Bids: Participants submit price-quantity breakpoints for each hour of the following day. For sell-side price breakpoints, quantities are specified as negative values. As price breakpoints increase, quantities are expected to decrease (i.e., buy quantities should decrease, and the absolute value of sell quantities should increase). Hourly bids form a piecewise linear function by allowing linear interpolation between breakpoints. The matched quantity is determined as the quantity corresponding to the MCP on this piecewise linear function (EPİAŞ).

- Example: An hourly bid for a participant could be exemplified as follows:

| Price (₺/MWh) | 10 | 50 | 100 | 150 | 200 | 250 |

| Quantity (lot) | 200 | 150 | 100 | 50 | -50 | -100 |

- Block Bids: Block bids are similar to consecutive hourly bids that cannot be fragmented across time. They have a single price-quantity pair for their entire effective duration and are submitted with the condition that the entire offered quantity must be accepted or rejected. A block bid is either fully accepted or fully rejected for the period it is active.

- Linked Block Bids: If one block bid is linked to another, the linked bid is called a “child” bid, and the bid it is linked to is called a “parent” bid. If the parent bid is not accepted, the child block bid is also not accepted. A maximum of three block bids can be linked to each other, and they cannot form a circular dependency. Furthermore, linked block bids must be in the same direction (either all sell or all buy).

- Example: An example of a linked block bid:

| Block Bid | Duration | Price (₺/MWh) | Quantity (lot) | Linked Block |

| X | 1-4 | 120 | -200 | |

| Y | 2-6 | 15 | -80 | X |

In this example, for block bid Y to be accepted, block bid X must also be accepted. This example has been generated using artificial intelligence.

- Flexible Bids: Flexible bids contain only price and quantity information. They can be accepted in any single hour of the day, independent of specific hours. In the current market structure, they can only be submitted as sell bids. Flexible bids are also either fully accepted or fully rejected. The hour in which the bid is accepted does not necessarily have to be the hour with the highest MCP; however, if the bid price is below the highest MCP, the bid is accepted for a suitable hour.

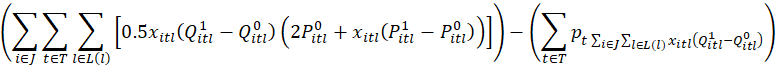

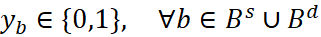

2. Optimization Model and Objective Function: EPİAŞ’s algorithm determines matched quantities in a way that maximizes daily market surplus. Daily market surplus is the sum of daily producer and consumer surpluses, calculated using hourly, block, and flexible bids.

- Producer Surplus: Producer surplus for a participant is the difference between the total amount to be received for the matched sell quantity and the amount offered to the market for selling that quantity.

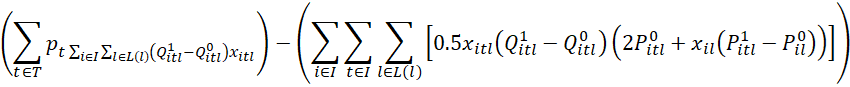

- Producer Surplus from Hourly Bid

- Producer Surplus from Block Sell Bids:

- Producer Surplus from Flexible Sell Bids: (Assuming Nb =1)

- Consumer Surplus: Consumer surplus for a participant is the difference between the amount offered to the market for the matched buy quantity and the amount to be paid for receiving that quantity (EPİAŞ).

- Consumer Surplus from Hourly Bids:

- Consumer Surplus from Block Buy Bids:

3. Constraints: The market results must satisfy the following conditions:

- Supply-Demand Balance: Supply must equal demand in each period.

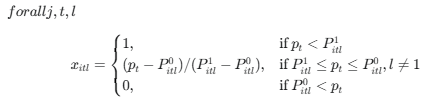

- Hourly Bid Matching Quantity: The matched quantity of an hourly bid corresponds to the MCP at that specific hour. If there is no price breakpoint corresponding to the MCP in the hourly bid, the matched quantity is found according to the linear interpolation rule (EPİAŞ).

- For Sell Bids:

- For Buy Bids:

- Block Bid Acceptance: Block bids are either fully accepted or fully rejected; partial acceptance is not allowed. If a block bid is accepted, it is considered accepted for all periods it is valid (EPİAŞ).

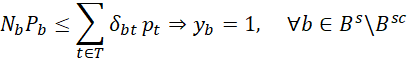

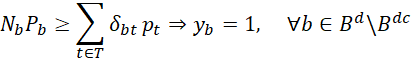

- Price Condition: Block sell bids are accepted if their price is less than or equal to the average MCP of the hours they are valid. Block buy bids are accepted if their price is greater than or equal to the average MCP of the hours they are valid. This rule does not apply to child blocks (EPİAŞ).

- Block sell bids:

- Block buy bids:

- Child Block Constraint: A child block bid cannot be accepted unless its parent block bid is also accepted.

- Flexible Bid Acceptance: Flexible bids are either fully accepted or fully rejected.

- Price Condition: A flexible bid must be accepted if its price is less than or equal to the highest MCP.

- Single Period Constraint: A flexible bid can be accepted in at most one period.

4. Solution Method: The problem is solved through four main modules: pre-processing, heuristic algorithms, optimization, and post-processing algorithms (EPİAŞ).

- Pre-processing: In this stage, data is read, hourly bids for each hour are aggregated into a single bid (aggregation), and variable elimination is performed to reduce the problem size without losing the optimal value (EPİAŞ).

- Heuristic Algorithms: To provide the optimization module with an initial solution that has a high total surplus, two heuristic algorithms, such as Tabu Search and Genetic Algorithm, run in parallel. These algorithms focus on finding the block bid combination that yields the best total surplus, treating flexible bids as non-existent (or rejected). Once the most suitable block combination is found, flexible bids are added to this solution (EPİAŞ).

- Optimization: The solution obtained from the heuristic algorithms is fed into a mathematical programming solver, aiming to find the best solution within a specified time limit. Both the constrained and unconstrained models (where constraints ‘e’ and ‘g’ of the model are absent) are solved by this solver. If the unconstrained model satisfies constraints ‘e’ and ‘g’, this solution is taken as the final solution. Otherwise, the constrained model is solved, the solution of the unconstrained model is repaired to satisfy constraints ‘e’ and ‘g’, and these two solutions are compared to declare the one yielding the highest total surplus. The problem is modeled as a Mixed Integer Quadratic Program (MIQP) (EPİAŞ).

- Post-processing: This module includes the curtailment procedure applied in cases of supply or demand surplus, solution verification and repair algorithms, and reporting. Verification algorithms check the conformity of solutions produced by the heuristic and optimization modules with the constraints stated in Section 3.2. If a generated solution does not satisfy these constraints, a repair algorithm is used to make the solution feasible (EPİAŞ).

5. Demand or Supply Surplus Situations: In cases of energy deficit (demand surplus) or energy surplus (supply surplus), the supply and demand in the system cannot be balanced within the currently valid price limits in the market and while satisfying all the constraints mentioned in the preceding section. In such situations, to ensure supply-demand balance, hourly bids are curtailed, and the acceptance conditions for block and flexible bids may not be met (EPİAŞ).

- Energy Surplus: In an energy surplus situation, the MCP for that hour is set at the minimum price (P_min). In this case, the total demand offered to the market at the minimum price (Demand(P_min)) is less than the total supply at this price (Supply(P_min)). The energy surplus in an hour is calculated as the difference between the supply and demand corresponding to the minimum price for that hour: Supply(P_min)−Demand(P_min) (EPİAŞ).

- Energy Deficit: In an energy deficit situation, the MCP for that hour is set at the maximum price (P_max). In this case, the total supply offered to the market at the maximum price (Supply(P_max)) is less than the total demand at this price (Demand(P_max)). The energy deficit in an hour is calculated as the difference between the demand and supply corresponding to the maximum price for that hour: Demand(P_max)−Supply(P_max) (EPİAŞ).

Now, let’s illustrate these explanations with an example:

(This example has been generated using artificial intelligence.)

In this example, we will use hypothetical data for a single hourly period (e.g., 1:00 PM). Hypothetical Data (for 1:00 PM):

- Market Clearing Price (MCP): 175 ₺/MWh

Bids:

- Hourly Sell Bid (Participant S1):

- Breakpoints:

- Price: 150 ₺/MWh, Quantity: -100 lots (10 MWh)

- Price: 200 ₺/MWh, Quantity: -150 lots (15 MWh)

- Breakpoints:

- Hourly Buy Bid (Participant D1):

- Breakpoints:

- Price: 200 ₺/MWh, Quantity: 80 lots (8 MWh)

- Price: 100 ₺/MWh, Quantity: 0 lots (0 MWh)

- Breakpoints:

- Block Sell Bid (Participant B1):

- Duration: Assumed active only for 1:00 PM (Nb=1, δb,13:00=1)

- Price: 160 ₺/MWh

- Quantity: -50 lots (5 MWh)

- Acceptance Status (yb): A block bid is accepted if its price is less than or equal to the average MCP (which is the MCP in this single-hour case). Since 160 ₺/MWh≤175 ₺/MWh, it was accepted (yb=1).

- Flexible Sell Bid (Participant E1):

- Price: 170 ₺/MWh

- Quantity: -20 lots (2 MWh)

- Acceptance Status (zf,13:00): A flexible bid is accepted if its price is less than or equal to the highest MCP (which is the MCP in this single-hour case) and if it is accepted in one period (zf,13:00=1). Since 170 ₺/MWh≤175 ₺/MWh, it was accepted (zf,13:00=1).

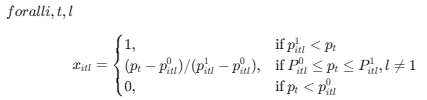

1. Calculation of Matched Quantities for Hourly Bids:

The matched quantity for hourly bids (xitl) is found through linear interpolation based on the MCP.

- Participant S1 (Hourly Sell Bid):

- MCP (175 ₺/MWh) is between the price breakpoints of 150 ₺/MWh and 200 ₺/MWh.

- Pitl0=150, Qitl0=−100

- Pitl1=200, Qitl1=−150

- Formula for sell bids: xitl=(pt−pitl0)/(pitl1−pitl0)

- xS1,13:00=(175−150)/(200−150)=25/50=0.5

- Matched Quantity (Qmatch): Qitl0+xitl(Qitl1−Qitl0)

=−100+0.5(−150−(−100))=−100+0.5(−50)=−100−25=−125 lots (12.5 MWh sell)

- Participant D1 (Hourly Buy Bid):

- MCP (175 ₺/MWh) is between the price breakpoints of 200 ₺/MWh and 100 ₺/MWh (for buy bids, quantity decreases as price decreases).

- Pitl0=200, Qitl0=80

- Pitl1=100, Qitl1=0

- Formula for buy bids: xitl=(pt−Pitl0)/(Pitl1−Pitl0)

- xD1,13:00=(175−200)/(100−200)=−25/−100=0.25

- Matched Quantity (Qmatch): Qitl0+xitl(Qitl1−Qitl0)

=80+0.25(0−80)=80+0.25(−80)=80−20=60 lots (6 MWh buy)

2. Calculation of Producer Surplus:

- Participant S1 (Hourly Sell):

- pt=175, Qitl0=−100, Qitl1=−150, Pitl0=150, Pitl1=200, xitl=0.5

- Surplus Formula: pt(Qitl1−Qitl0)xitl−[0.5xitl(Qitl1−Qitl0)(2Pitl0+xitl(Pitl1−Pitl0))]

- Term 1 (Revenue): 175⋅(−150−(−100))⋅0.5=175⋅(−50)⋅0.5=−4375 (This is revenue obtained via MCP; due to negative quantity, it can be viewed as cost.)

- Term 2 (Bid cost): 0.5⋅0.5⋅(−50)⋅(2⋅150+0.5⋅(200−150)) =0.25⋅(−50)⋅(300+0.5⋅50)

=−12.5⋅(300+25)

=−12.5⋅325=−4062.5

- Producer Surplus: −4375−(−4062.5)=−4375+4062.5=−312.5 (in lot-TL)

- Note: This calculation is in lot-TL and might be interpreted differently when converted to MWh. Generally, producer surplus is expected to be positive; this outcome might stem from the simplification of the example or the general structure of the formula.

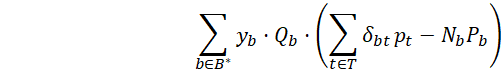

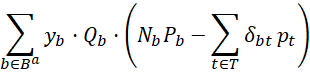

- Participant B1 (Block Sell):

- Bid accepted (yb=1)

- Qb=−50 lots, Nb=1 (single hour), Pb=160 ₺/MWh, ∑t∈Tδbtpt=175 ₺/MWh

- Surplus Formula: yb⋅Qb⋅(∑t∈Tδbtpt−NbPb)

- Producer Surplus: 1⋅(−50)⋅(175−1⋅160)=−50⋅(15)=−750 (in lot-TL)

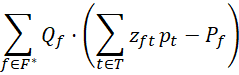

- Participant E1 (Flexible Sell):

- Bid accepted (zf,13:00=1)

- Qf=−20 lots, Pf=170 ₺/MWh, ∑t∈Tzftpt=175 ₺/MWh (Flexible bid is only valid in the hour it is accepted)

- Surplus Formula: Qf⋅(∑t∈Tzftpt−Pf)

- Producer Surplus: (−20)⋅(175−170)=−20⋅5=−100 (in lot-TL)

3. Calculation of Consumer Surplus:

- Participant D1 (Hourly Buy):

- pt=175, Qitl0=80, Qitl1=0, Pitl0=200, Pitl1=100, xitl=0.25

- Surplus Formula: [0.5xitl(Qitl1−Qitl0)(2Pitl0+xitl(Pitl1−Pitl0))]−pt(Qitl1−Qitl0)xitl

- Term 1 (Bid value): 0.5⋅0.25⋅(0−80)⋅(2⋅200+0.25⋅(100−200)) =0.125⋅(−80)⋅(400+0.25⋅(−100)) =−10⋅(400−25) =−10⋅375=−3750

- Term 2 (Amount paid): 175⋅(0−80)⋅0.25=175⋅(−80)⋅0.25=−3500

- Consumer Surplus: −3750−(−3500)=−3750+3500=−250 (in lot-TL)

4. Supply-Demand Balance Check (for 1:00 PM):

- Supply:

- S1 (Hourly Sell Match): −125 lots (sell, negative quantity)

- B1 (Block Sell Acceptance): −50 lots (sell, negative quantity)

- E1 (Flexible Sell Acceptance): −20 lots (sell, negative quantity)

- Total Supply: (−125)+(−50)+(−20)=−195 lots

- Demand:

- D1 (Hourly Buy Match): 60 lots (buy, positive quantity)

- Total Demand: 60 lots

- Balance Check: Total Buy – Total Sell should equal 0.

- 60 lots−(−195 lots)=60+195=255 lots

- Here, an imbalance of 255 lots occurred. A real DAM algorithm would iteratively adjust the MCP to balance the market. This example is simplified to merely demonstrate how the formulas are applied and uses an MCP value that does not result in balance. The optimization algorithm would optimize the MCP and bid matches to bring this imbalance to zero and maximize market surplus.

This example illustrates the fundamental mechanisms and formula applications used by EPİAŞ to solve the complex mathematical optimization problem. In a real market, calculations are far more intricate due to numerous participants, thousands of bids, and additional constraints (such as transmission limits, power plant technical limits, etc.), necessitating specialized optimization software.

2.6. The Importance of the DAM for HPPs

For hydroelectric power plant (HPP) operators, the DAM is more than just a pricing bulletin—it is a strategic decision-making platform (HESİAD).

• Planning = Profit Estimation and Optimal Resource Use:

Thanks to their storage capabilities, HPPs use water as a “storable fuel.” DAM prices provide strong signals as to when this “fuel” becomes most valuable. By analyzing DAM price curves, HPP operators can plan next-day production, optimize water allocation, and maximize potential profit. Proper planning ensures that water is converted into energy at the most profitable moment (DSİ).

• Reducing Imbalance Risk and Avoiding Penalty Mechanisms:

In electricity markets, any deviation between declared and actual generation or consumption is considered an “imbalance.” These imbalances may result in additional costs (penalties) through the Balancing Power Market (BPM) mechanisms (EPİAŞ). Submitting accurate and realistic DAM bids helps HPPs avoid unnecessary exposure to balancing mechanisms and thus minimizes potential imbalance costs (TEİAŞ).

• Water Management and the “Price-Timing” Relationship:

An HPP’s most valuable asset is water. The DAM offers HPP operators the opportunity to integrate water management with market prices. Generating electricity during high PTF hours (peak hours) and storing water during low PTF hours (off-peak hours) can significantly increase a plant’s revenue. This “price-timing” relationship is especially crucial for reservoir-based HPPs, requiring long-term strategic management of water reserves (HESİAD). Simply put, the key is to capture the moment when water yields the highest return per kWh.

2.7. Example Scenario with Real DAM Data: Strategic Decision for an HPP

Let’s concretize the theoretical operation of the DAM with a real-world example.

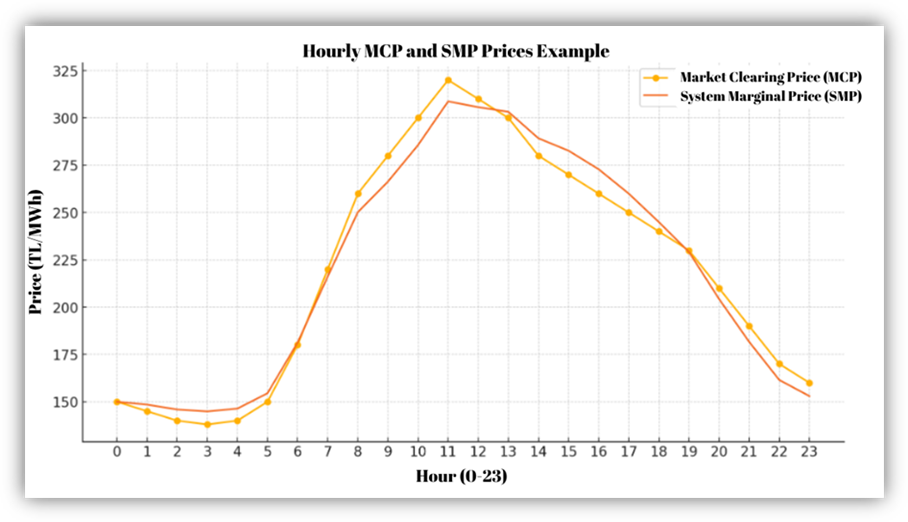

- Hourly Price Curve on June 21, 2025 (Example Data): Let’s assume that the DAM results for June 21, 2025, were as follows:

| Hour | MCP (TL/MWh) | Description | |

| 01:00 | 1500 | Low Night Demand | |

| 02:00 | 1450 | Low Night Demand | |

| … | … | … | |

| 07:00 | 1800 | Morning Start | |

| … | … | … | |

| 11:00 | 2500 | Business Hours Peak | |

| 14:00 | 2700 | Highest Demand / Price | |

| 15:00 | 2650 | Demand Remains High | |

| … | … | … | |

| 20:00 | 2200 | Evening Demand Declining | |

| … | … | … | |

| 24:00 | 1600 | Transition to Night |

• “14:00 PTF = 2700 TRY/MWh – How Much Should Have Been Produced?”

In this scenario, the HPP operator correctly forecasts on June 20 that the PTF for 14:00 on June 21 will reach a high value of 2700 TRY/MWh. The HPP has a total daily water flow of 10,000 m³/day, a turbine efficiency of 90%, and a net head of 50 meters. The plant’s capacity is 20 MWh/hour. Under a standard production plan, the HPP could have operated with a constant generation of 10 MWh/hour throughout the day. However, this approach would not fully capitalize on the price spike at 14:00. This is where the principle of “maximize revenue, not production” comes into play. If storage capacity and ramping constraints allow, the HPP should aim to operate at maximum capacity (20 MWh) during that high-price hour. (Example scenario created by artificial intelligence)

• Comparison of 3 Different Bidding Strategies:

Let’s analyze three possible DAM bidding strategies for an HPP operator on June 21, 2025:

- Flat Baseload Bid: Offer a steady 10 MWh/hour production for every hour of the day.

▪ Advantage: Simplicity; lower imbalance risk (if forecasts are accurate).

▪ Disadvantage: Misses price spikes. For example, only selling 10 MWh at 2700 TRY/MWh at 14:00 results in lost potential revenue.

▪ Estimated Revenue: 10 MWh × (average of MCP across 24 hours) × 24 hours. - Price-Focused Strategy (Using Block Bids): Focus on hours with expected high MCPs.

▪ Strategy: Submit 20 MWh/hour (max capacity) from 12:00–16:00 (4-hour block) and 6 MWh/hour during other hours.

▪ Advantage: Maximizes gains during peak hours; enables strategic water use.

▪ Disadvantage: Risk of the entire block bid being rejected; more complex water management.

▪ Estimated Revenue: (20 MWh × high MCP hours) + (6 MWh × low MCP hours) − (balancing costs, if any). This strategy could yield significantly higher income than the first. - Dynamic Flexible Bidding (Hourly Optimization): Offer optimal production for each hour based on forecasted MCPs.

▪ Strategy: Adjust production per hour—e.g., 20 MWh at 14:00, 5 MWh at 02:00—using advanced optimization software.

▪ Advantage: Highest revenue potential; full adaptation to market fluctuations.

▪ Disadvantage: Most complex strategy; heavily dependent on accurate MCP forecasts; greater imbalance risk if forecasts fail.

▪ Estimated Revenue: MWh × MCP per hour (maximizing total income).

This example clearly illustrates that the DAM is not merely an operational tool for HPP operators but also a strategic platform that directly impacts revenue and profitability. (Example scenario created by artificial intelligence)

3. Market Clearing Price (MCP): What Is It and How Should It Be Interpreted?

The Market Clearing Price (MCP) is the unique price formed in the DAM for each hour, used in all buy-sell transactions in the Turkish electricity market. As a vital indicator that reflects the pulse of the electricity market, understanding the dynamics of the PTF is essential for anyone involved in energy trading (EPİAŞ).

3.1. Definition and Distinction: MCP vs SMP

Although the terms MCP and System Marginal Price (SMP) are often used interchangeably, there is a significant technical and conceptual distinction between them (EPİAŞ):

• MCP – Transaction Price for Market Participants:

MCP is the uniform price at which all matched buy and sell transactions are settled in the DAM. That is, every buyer in the market pays, and every seller receives, this same price per MWh during the corresponding hour. It is the final price that directly determines market participants’ payments and revenues (EPİAŞ).

• SMP – Marginal Balance Point for the System:

SMP represents the theoretical cost of producing or consuming one additional unit of electricity, formed at the intersection of the supply and demand curves. In the DAM, the MCP is usually set equal to the SMP. However, under certain special conditions—such as transmission constraints (grid bottlenecks) or regional pricing mechanisms—small differences may arise between MCP and SMP. For the system operator (TEİAŞ), SMP is a more relevant indicator for understanding the system’s overall cost-efficiency and marginal generation unit (EPİAŞ, TEİAŞ).

3.2. Factors Determining MCP Dynamics

The MCP, much like a financial market, constantly fluctuates under the influence of numerous internal and external factors. A deep understanding of these factors is essential for developing MCP forecasting models and managing risks.

- Meteorological Conditions (Drought, Temperature, Wind, Solar): Weather conditions are one of the most decisive natural factors affecting the MCP.

- Temperature: Rising temperatures in summer boost air conditioning use, causing electricity demand to peak, while cold temperatures in winter increase heating demand. These surges in demand push the MCP upwards (HESİAD).

- Drought: A decrease in water, the primary fuel for HPPs, restricts hydroelectric generation. This situation forces more expensive thermal power plants into operation in the market, driving the MCP higher (HESİAD).

- Wind and Solar: Wind speed and solar irradiance directly affect the output of wind and solar power plants (WPPs, SPPs). When the generation from these renewable sources increases (during windy/sunny weather), the supply of cheap electricity to the market rises, and the MCP tends to fall. Conversely, the MCP can increase (HESİAD).

- Fuel Prices (Natural Gas, Coal, Oil): Natural gas and coal have a significant share in Turkey’s electricity generation mix. Fluctuations in the global market prices of these fuels, exchange rate movements, and national taxation policies directly impact the MCP. Especially natural gas power plants, due to their flexibility, often act as the marginal price-setting resources. A single unit increase in natural gas prices can raise the bid prices of natural gas power plants, consequently increasing the MCP (EPİAŞ).

- Generation Type and Cost Structure (Baseload, Flexible Resources):

- Baseload Power Plants: Facilities like nuclear and some coal-fired power plants, typically with low marginal costs (but high fixed costs), generally operate at a constant output for most of the day, covering the market’s baseload demand.

- Mid-Load and Peaker Plants: More agile power plants like combined cycle gas turbines (CCGTs), which can start up and shut down faster but have higher marginal costs, come into operation during “peak” hours when demand increases or baseload plants are insufficient, thereby determining the MCP (EPDK, EPİAŞ).

- Technical Faults, Maintenance Plans, and Transmission Constraints: Unexpected outages or planned maintenance work at large generation plants instantly reduce market supply and can cause the MCP to rise. Additionally, capacity constraints in electricity transmission lines (transmission congestion) can also lead to regional price differentiations or increases in the MCP in certain areas (TEİAŞ, EPİAŞ).

3.3. Formulating HPP Strategies Based on the Market Clearing Price (MCP)

For hydropower plants (HPPs), the PTF is more than just an indicator; it is a fundamental signal shaping both operational and financial strategies.

• Matching Forecasts with Timing and Arbitrage Opportunities:

HPP operators attempt to predict future PTF trends using advanced forecasting models and market analyses. These forecasts are used to plan the optimal utilization of water resources. The core strategy involves storing water when it is “cheap” (i.e., when the opportunity cost is low) and converting it to electricity for sale when prices are “expensive” (i.e., when high PTF values are expected). This approach, known as price arbitrage, is the most effective strategy enabled by the natural storage capability of HPPs (HESİAD).

• Increasing Generation During High PTF Hours:

Typically, on business days, electricity demand peaks during morning and evening hours, causing the PTF to rise. As long as ramping capabilities and reservoir levels permit, HPPs can maximize their generation during these high-price hours to optimize revenue. This strategy is the main focus of daily or weekly water management for reservoir-based hydropower plants (EPİAŞ).

• Efficiency Analysis and Risk Management Through Price-Water Scenarios:

Using advanced software and analytical models, it is possible to perform detailed efficiency analyses under various PTF forecast scenarios (optimistic, realistic, pessimistic), different hydrological conditions (drought, normal, wet), and operational constraints of the HPP (turbine efficiency, water level limits). These analyses help pre-assess potential revenues, costs, and risks. Furthermore, risk mitigation strategies against price fluctuations in the DAM can be developed by using bilateral contracts or financial hedging instruments. This is crucial for ensuring the financial stability of HPP operations (DSİ).

RENEWASOFT’S SOLUTION – DAM + MCP Supported Decision Module

The complexity of the Turkish electricity market and the continuous variability of the MCP can make it challenging for HPP operators and energy trading companies to make the right decisions at the right time. At Renewasoft, we offer a comprehensive solution designed specifically to help you overcome these challenges, improve your efficiency, and maximize your revenues: the DAM + MCP Supported Decision Module.

Why Renewasoft’s Solution?

We provide an AI-powered, comprehensive, and user-friendly platform that enables you to turn market uncertainties into opportunities.

🔹 MCP + Forecast Integration: See the Future, Make Instant Decisions

Our module integrates reliable MCP forecasts obtained using advanced algorithms and machine learning models into your system. This integration makes your operational decisions data-driven.

- → Hourly MCP is Visually Highlighted on the Forecast Screen: Through our intuitive interface, you can instantly view and analyze hourly MCP forecasts for the next day and even longer terms. High-price hours are highlighted with color coding and visual markers, making revenue opportunities immediately apparent. This visualization supports your rapid decision-making processes.

- → Optimal Generation Hours for HPPs are Emphasized: Our system doesn’t just display MCP forecasts; it also takes into account your HPP’s technical constraints (max/min capacity, ramping rates) and real-time water reservoir levels, automatically suggesting the most profitable generation quantity and thus the optimal generation hours for each hour. This allows you to utilize your water resources most efficiently and maximize your revenue potential.

🔹 MCP-Generation Deviation Report: Identify and Prevent Missed Opportunities

We offer detailed reporting capabilities that help you analyze your past generation data and realized MCP values to identify potential revenue losses.

- → “Generation Was Low During High MCP Hours” Alert: Our module analyzes historical data to automatically detect when your HPP’s generation fell short of its potential during high MCP hours (e.g., above 2500 TL/MWh). This detection allows you to calculate your lost opportunity cost and review your strategies to prevent similar situations in the future.

- → Daily Email or In-System Notification to Inform Management: These critical alerts and deviation reports are delivered instantly to relevant managers and energy trading teams via customizable daily email notifications or in-system alerts. This proactive communication ensures swift action and continuous monitoring of operational efficiency.

🔹 Automated Alerts and Reporting: Proactive Management, Smart Decisions

Our module continuously monitors market dynamics and generates automated alerts and comprehensive reports based on your predefined criteria.

- → “Tomorrow 10:00 AM MCP > 2000 TL – Your Generation Plan Seems Insufficient”: The system automatically notifies you when DAM results or forecasts exceed your specified price thresholds (e.g., “MCP is expected to be over 2000 TL/MWh tomorrow at 10:00 AM, and your current generation plan is not adequately leveraging this high-price opportunity”). These alerts allow you to immediately review your daily planning.

- → Generation Suggestion Ranked by MCP: Renewasoft’s module not only alerts but also provides concrete solutions. By analyzing MCP forecasts and all operational constraints of your HPP, such as current water levels, daily flow, turbine efficiency, and capacity, it offers hourly generation suggestions optimized for the most profitable hours for the next 24 hours or longer periods. These suggestions can be automatically adjusted or manually implemented to maximize your plant’s revenue.

Understand the Complex Dynamics of the Turkish Electricity Market Better with Renewasoft’s DAM + PTF Supported Decision Module.

Make data-driven and proactive decisions. Maximize your plant’s efficiency and revenue potential. To stay one step ahead in the market and gain a competitive advantage, contact us for more information or to request a demo. (Renewasoft)

References

• Energy Markets Operating Company (EPİAŞ): Market operation rules, current market data, and reports. Retrieved from https://www.epias.com.tr

• Turkish Electricity Transmission Corporation (TEİAŞ): System balance, transmission, and supply-demand statistics. Retrieved from https://www.teias.gov.tr

• Energy Market Regulatory Authority (EPDK): Electricity market legislation and regulations. Retrieved from https://www.epdk.gov.tr

• Association of Hydroelectric Power Plant Operators (HESİAD): Sector reports, analyses, and publications related to hydroelectric energy. Retrieved from https://www.hesiad.org.tr

Note: The MCP example scenario, numerical examples explaining algorithm functionalities, specified price and timing information, and all visuals included in this text are fictional content entirely generated by artificial intelligence. The purpose is to better explain general market dynamics and calculation steps. They do not represent actual market data.